Cart

0

Product

Products

(empty)

No products

To be determined

Shipping

0,00€

Total

Product successfully added to your shopping cart

Quantity

Total

There are 0 items in your cart.

There is 1 item in your cart.

Total products

Total shipping

To be determined

Total

Categories

-

Jet ski accessories

- Seadoo Accessories

- Jet ski anchors

- Audio

- Jet-ski covers

- Gasoline transport container

- Arm for jet to arm

- Foot rests

- Column & Platinum

- Commodo

- Circuit breaker

- Jet ski fenders

- Re-embarkation scale

- Distress flares

- Jet ski trigger

- Jet-ski handlebar

- Saddle covers

- Jet Ski Graphic Kit

- Peach

- Jet ski grips

- Floating pontoons

- Storage (bag, bin ...)

- Jet-ski safety

- License stickers

- Hydroturf / Jettrim mat

- Buoy to tow

- Jet pilot equipment

-

Jet ski maintenance

- Jet-ski starting aid

- Engine additives

- Jet ski batteries

- NGK candles

- Fuels

- Jet ski compressor

- Jet-ski degreaser

- Hoses and accessories

- Electric jet ski

- Jet-ski hull maintenance

- Water evacuation

- Air filter

- Oil filter

- Oil filter

- Marine grease

- Wintering

- Engine oil

- Turbine oil

- Protective lubricant

- Jet ski cleaning

- Jet-ski tools

- Joint paste

- Hull / engine paint

- Cooling

- Revision (full pack)

- Rinsing (tips)

- Workshop services

- Fuel stabilizer

- Thermostats

- Flyboard / Flyride

- Kawasaki jet ski

- Seadoo jet-ski

- Yamaha jet ski

- JetSurf

- JetXtender

- Jet-ski & Trailer Rental

- Jet-ski occasions

-

Jet ski adaptable parts

- Jet ski cables

- Carburation / injection

- Shell

- Electric jet ski

-

Jet ski engine

- camshaft

- balancing shaft

- Connecting rod in kit

- needle cages, pin and circlips

- Crankcase

- distribution chain

- cylinder liner

- Compressor

- Pads

- cylinder head

- cylinders

- exhaust hose

- Exchanger / Intercooler

- jet ski oil filter

- 2-stroke seals

- 4-stroke seals

- SBT Complete Engine

- jet ski piston

- oil pump

- piston rings

- valves

- jet-ski engine mount

- Thermostat

- valves

- jet-ski crankshaft

- jet-ski engine bolts

- Jet ski tools

- Jet ski propulsion

- Trim VTS

- Original jet-ski parts

- Jet-ski racing parts

- Underwater Thruster

- Jet ski trailers

- Wakeboard / Paddle / Water Toys

- Destocking

vehiculier

|

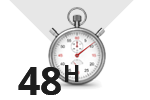

Please note since 2013 VNMs are subject to an annual francization and navigation tax or the annual passport fee. |

Every year

A payment advice is sent to you, showing the amount of the DAFN to be paid, calculated according to the following scale.

up to 90 kW excluded: no taxation.

- From 90 kW to 159.9 kW: € 3 per kW or fraction of kW, from the first kW.

- from 160 kW: € 4 per kW or fraction of kW, from the first kW.

- This right is collected according to the time left to run until the end of the year (a month started = a whole month).

- Thus, for a water scooter francized in June, the sum to be paid will be 7 / 12th of the annual fee.- Deductions for obsolescence are provided for VNMs aged 10 and over, as well as certain exemptions for jet skis belonging to nautical sports schools.Taxed vessels benefit from obsolescence allowances, applicable to both the hull and the engine, the rates of which are as follows:

- 33% for boats from 10 to 20 years old;

- 55% for boats from 20 to 25 years old;

- 80% for boats over 25 years old.

View the table with all the tariffs according to the powers ![]()

(source jet-net.org)